Family office Hub

Family office Hub

Art Investment Intelligence

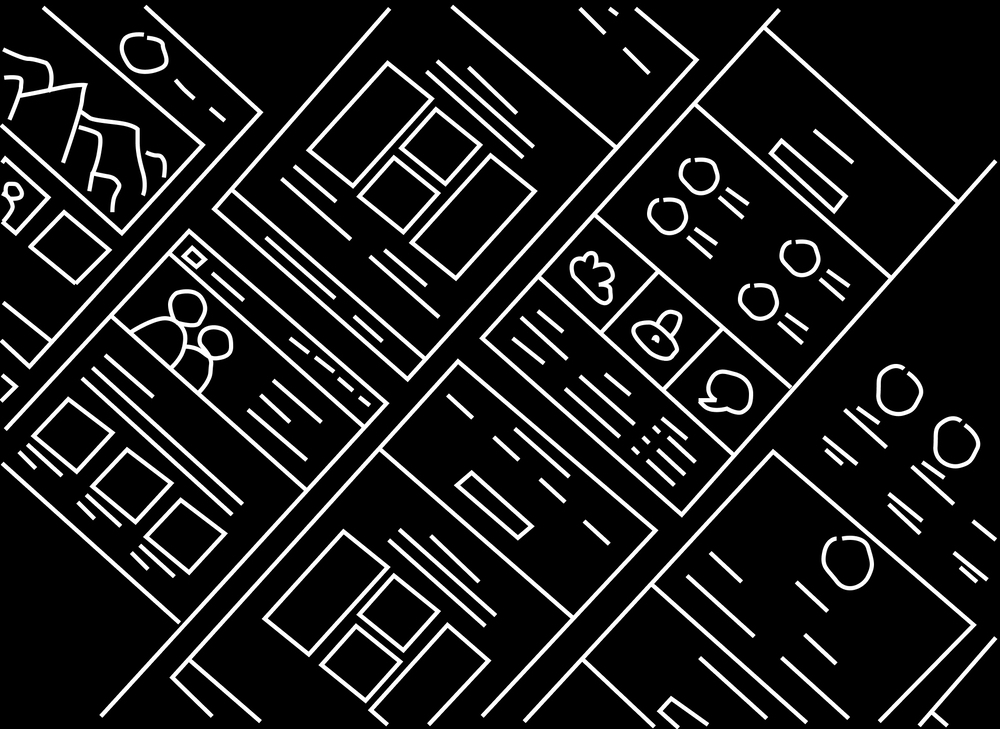

Your all-in-one platform for managing the Art assets

Empower both founding families and next-gen

clients with seamless portfolio management.

Position art as a high-performing asset class with Arty Traders.

Our exclusive model is the result of 14 years of research and testing. We incorporated off-market data with publicly available online information, along with expert insights into the artwork’s structure, the artist’s activity, reputation, trend analysis and various aspects reflecting on Artwork price and trend analysis,

How it Works?

We provide you with

ArtyTraders proprietary tool

so you can:

Maximize your Performance fees and AUM-based Management fees

Diversify your portfolios beyond traditional assets through Arty Traders Portfolio Builder

Get price alerts - ArTBitrage and Smart exit strategies

Use our Art Index and VPR tool to make data-driven investment decisions

Authenticate artwork with top experts in the market

Get industry insights with our AI-analytics tool

Maximize your Performance fees and AUM-based Management fees

+

Our model supports returns exceeding 30% in 5 years, helping you maximize performance feesonprofitable investments.

With fractional ownership, you can hold the ownership of your Artwork, while also monetizing throughselling shares and unlocking new revenue opportunities such as renting Artwork.

Diversify your portfolios beyond traditional assets through Arty Traders Portfolio Builder

+

Increase your Assets Under Management (AUM) by incorporating art as an investment option.

Offer Art as an alternative to crypto, stocks, bonds and precious metals, giving your clients a well-balanced portfolio.

Get price alerts - ArTBitrage and Smart exit strategies

+

ArTBItrage - one of our core solutions - Price Alerts System – Get real-time alerts on when to sell or acquire high-potential artwork.

Unlike traditional art investments, we ensure liquidity, allowing you to exit the market at the most profitable moment.

Use our Art Index and VPR tool to make data-driven investment decisions

+

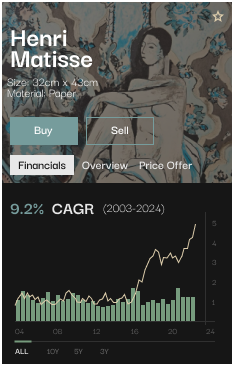

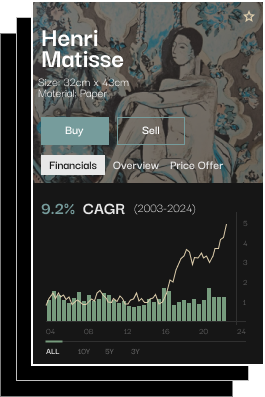

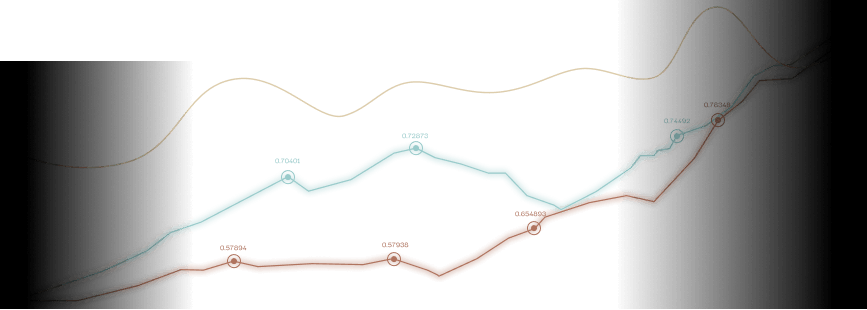

The world's first proprietary Art Valuation and Prediction Tool provides a unique, real-time index for your artwork, secured by blockchain technology.

Authenticate artwork with top experts in the market

+

We have a network of world renowned experts to provide you with COA and other necessary documents and appraisals, so that you can have everything in one place.

Get industry insights with our AI-analytics tool

+

Optimize decision-making with our AI-powered analytics tools and industry insights, including reports and Art market related news.

Art valuation

Art valuation

Art price prediction

Art price prediction

Portfolio builder

Portfolio builder

Database

Database

Integration and usage

Integration and usage

Artist and Artwork selection

Artist and Artwork selection

Liquidity

Liquidity

Fractional purchase

Fractional purchase

Case Studies

Challenge: Portfolio Diversification, High-Return Alternative Investments

A New York-based multi-family office, which had historically focused on stocks, bonds, and real estate, has contacted Arty Traders for Consulting after the rise of increasing market volatility and inflation risks. They were looking for a stable, high-return alternative investment.

The firm wanted to:

- Diversify their portfolio

- Ensure liquidity in the art asset class, which is typically known for long holding periods

- Generate performance-based returns to increase their management fees

However, the family office lacked expertise in the art market, had concerns about liquidity, and needed data-driven insights to make intelligent investment decisions.

Solution: Arty Traders partnered with the family office to provide a comprehensive art investment solution.

We approached this challenge by:

- Identified undervalued artworks

- Selected modern and rising star artists with an appreciation rate of 12%–15% annually.

- Recommended 3 high-value pieces based on the client’s risk appetite.

- Provided real-time alerts for optimal buy/sell timing based on market insights.

- Helped the firm exit one artwork at an 18% profit in 2 years, aligning with their return expectations.

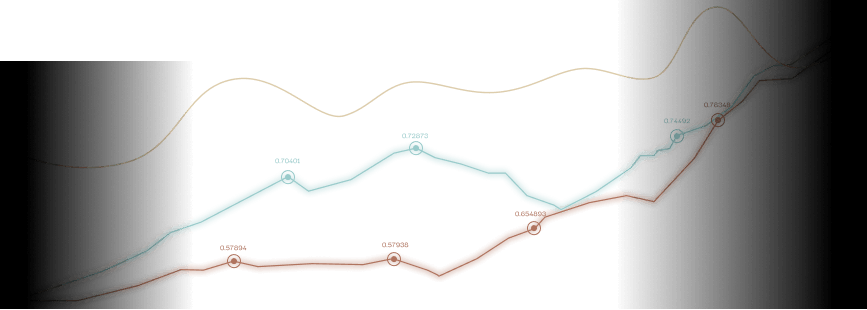

Results: Strong Returns & Scalable Investment Model

- 24% average annual return on acquired artworks

- Generated $1.2M in profits in 3 years

- Increased AUM-based fees for the family office due to art’s mid-term appreciation

- Scalable model allowing the family office to continue its successful journey in art investments.

Client Testimonial

“Arty Traders opened a new chapter for us in art investment. Their AI-driven insights, liquidity solutions, and innovative strategies have not only enhanced our returns but also provided a more structured approach to managing art assets. What was once a passion-driven pursuit is now a strategic pillar of our investment portfolio.”

— Managing Director, New York Family Office

Challenge: The Swiss family office had a decades-long appreciation for fine art, with several members of the family being collectors and artists themselves. However, their approach to art acquisition was emotionally driven rather than financially strategic, which was causing:

- Overpaid artworks due to lack of market insights

- Holding of illiquid assets with no clear exit strategy

- No valuation tracking, which made it difficult to determine art portfolio performance

The family wanted to preserve their legacy through art, but also ensure it remained in the family portfolio as a strategic financial asset.

Solution: Arty Traders provided a customized art investment roadmap, which helped the family office to balance their passion with investment profitability. How?:

- Arty Traders conducted a portfolio audit of their existing collection, identifying both undervalued and overvalued pieces.

- Advised on some off-market acquisitions, securing three rare 20th-century masterpieces at 18% below the market value.

- Introduced emerging artists with potential for 3X appreciation in 10 years, ensuring a mix of blue-chip and growth investments in their portfolios.

- Integrated the family’s collection into Arty Traders’ AI-driven valuation tool, providing real-time price tracking.

- Set up annual valuation reporting, aligning art holdings with the family’s overall financial strategy.

- Provided direct access to private sales networks, which reduced their dependance on traditional auction houses.

Results: A legacy collection that generates financial value

- Reduced acquisition costs by 20%, optimizing long-term appreciation

- An increased collection value by $1M in 3 years, combining market appreciation and strategic acquisitions

Client Testimonial

“We have always loved collecting art, but never did we have a structured approach. Arty Traders helped us transform our collection into a financial asset. This helped us preserve our family’s legacy while optimizing our wealth strategy. We now see art as both an emotional and financial investment.”

— CEO, Geneva Family Office

Investment & Financial Returns

Arty Traders’ proprietary model combines off-market data, expert insights, and AI-driven valuation to identify undervalued artworks with high appreciation potential. Our valuation and price prediction tool continuously assesses factors such as the artist’s reputation, market demand, and historical pricing trends.

Arty Traders provides consulting services for the Family Offices that want to organize a fractional ownership of any Artwork, including blue-chip and rising star artists’ artworks. Fractional purchase allows investors to purchase shares in high-value artworks rather than acquiring the entire piece. Investors can monetize their shares through secondary market sales, while the Family office that will own the artwork can receive rental income from exhibiting artworks in galleries and corporate spaces.

- Market Volatility: Art prices can fluctuate based on trends, economic conditions, and artist activity. That is why Arty Traders analyzes these factors regularly and provide you with Price alerts and Market insights.

- Liquidity Risk: While art remains less liquid than stocks or bonds, Arty Traders enhances liquidity through its proven network of art collectors, art dealers and art traders, who ensure that there will always be a buyer on Arty Traders platform.

- Authenticity & Provenance Risks: Ensuring legitimacy is critical, that is why Arty Traders mitigates this through expert authentication.

Art investments have historically shown resilience during economic downturns, acting as a hedge against inflation. Unlike crypto and stocks, which are highly volatile, art provides more stable, long-term appreciation. Art is also a tangible asset, making it more comparable to gold or real estate.

Fees include:

- Transaction Fees: Applied to buying, selling, or renting artwork.

- Subscription Fees: For accessing advanced analytics and AI-driven insights.

- Consulting fees: Arty Traders charge for personalized case-based consulting services.

By including art in client portfolios, family offices can:

- Offer high-net-worth clients a diversified investment option.

- Capitalize on long-term appreciation and passive income from artwork rentals.

- Increase AUM by attracting new investors seeking alternative asset classes.

Liquidity & Exit Strategies

- Fractional ownership enables partial exits.

- Price alerts notify investors of optimal selling windows.

- A secondary market allows investors to trade shares in artworks.

- Rental opportunities provide continuous revenue without requiring a full sale.

- A proven network of art collectors, art dealers and art traders ensure that there will always be a buyer on Arty Traders platform.

Our AI-powered Smart Exit Strategy analyzes:

- Market demand trends

- Auction results

- Artist activity

- Collector interest levels

- Comparable artwork sales

Investors receive real-time price alerts when data suggests a high-value exit opportunity

ArTBItrage is our proprietary price alert system, leveraging:

- Global price tracking to find price discrepancies across markets.

- AI-driven historical analysis to predict short-term appreciation.

- Auction monitoring to identify undervalued pieces.

This enables investors to capitalize on market inefficiencies by buying low and selling high.

Technology & AI-Powered Tools

The AVP tool combines:

- Historical sales data

- Artist market trends

- Artwork composition & style analysis

- Macroeconomic indicators

- Gallery & auction activity

- Off-market data

- Expert assessment

It provides real-time price predictions, helping investors make data-driven decisions.

Yes. Arty Traders offers API integration for portfolio management platforms, enabling seamless tracking, valuation updates, and investment reporting.

Valuations are updated in real time based on:

- Recent transactions

- Market trends

- Off market transaction data and Auction results

- AI-based price predictions

AI plays a crucial role in analyzing vast datasets, identifying investment opportunities, and detecting market shifts with high accuracy (>85%). It evaluates historical price trends, artist reputation, collector demand, and macroeconomic factors in real-time to provide data-driven insights. However, since art also has a subjective element—driven by cultural trends, emotional appeal, and expert opinion—our team of seasoned art experts always provides the final validation for the results displayed, ensuring a balanced approach that combines AI precision with human expertise.

Authentication & Security

Arty Traders provide services of authentication, through its network of art experts to verify provenance.COA (Certificate of Authenticity) is one of the most requested certifications.

Our network features renowned art historians, gallery owners, and forensic analysts with credentials from leading Auction Houses and Art Institutions.

Arty Traders prevents fraudulent transactions and ensures provenance verification through a combination of AI-driven analysis, expert authentication. Our AI scans provenance records for inconsistencies, while a network of art specialists cross-validates ownership history and authenticity.

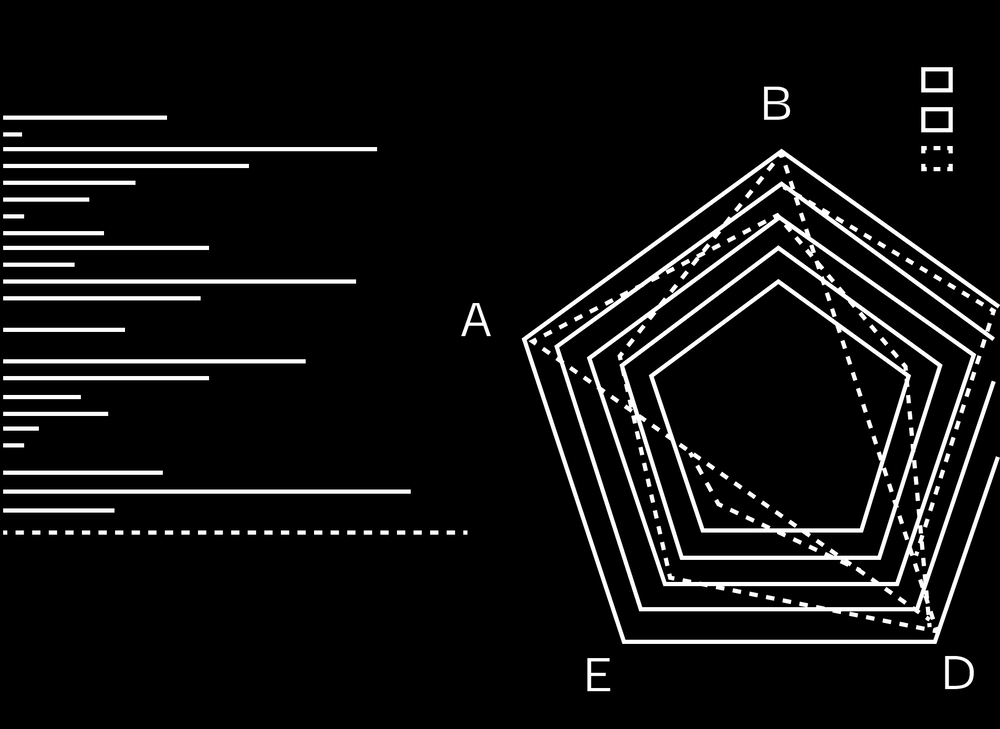

Portfolio Strategy & Market Performance

- Lower volatility than stocks & crypto.

- Higher appreciation potential than bonds.

- Non-correlated to financial markets.

- Stable store of value, similar to gold.

We recommend 5-20% of a portfolio be allocated to art for optimal diversification.

Art has historically outperformed stocks during recessions. The 2008 crisis saw blue-chip art appreciate while equities plummeted.

Yes. Our Portfolio Builder tailors recommendations based on:

- Risk appetite

- Investment timeline

- Liquidity needs