Wealth Management Companies Hub

Wealth Management Companies Hub

Art Investment Intelligence

For Wealth Management companies, Art Investment

strategy is no longer just about prestige but rather a data-backed financial opportunity.

Arty Traders

provides the technology, expertise, and Market Intelligence to

transform fine art into a profitable, high-performing asset class while

boosting AUM and increasing client retention.

Deliver the best experience to HNWI and UHNWI

(Ultra/High Net Worth Individuals),

Arty Traders is the World’s First Tool that helps Wealth managementt companies to unlock new revenue streams by incorporating blue-chip and high-growth/raising stars Art into their client Portfolios.

For over 14 years of research and testing, we have built a preparatory Model that merges off-market data, AI Analytics, and top Experts’ knowledge, to reach the best results in managing your Portfolio and increasing your revenue.

Whether your clients like collecting or just investing in Art, Arty Traders has confirmed that Fine Art and other collectibles constitute an important asset class.

How it Works?

We integrate Arty Traders’ proprietary model into your Wealth Management ecosystem, allowing you to:

Boost performance-based and management fees improving your client investments

- Boost your Management Fees by offering art as an alternative wealth preservation asset to your clients.

- Unlock new revenue streams with fractional ownership models, allowing clients to monetize existing artwork.

- Achieve 30%+ returns within five years by leveraging AI-backed price predictions and market insights.

Diversify Client Portfolios with Alternative Investments

- Enhance risk-adjusted returns by integrating art as an uncorrelated asset class alongside equities, bonds, and deposits.

- Offer art as an alternative investment to HNWI and UHNW clients seeking exclusive, tangible assets beyond crypto and traditional securities.

- Build tailored art investment portfolios, incorporating pre-owned and newly acquired artwork into your client’s wealth strategy.

Optimize Liquidity & Exit Strategies

- AI-powered ArTbitrage system provides real-time price alerts, helping advisors profit from profitable buying and selling moments.

- Unlike traditional illiquid art markets, Arty Traders offers strategic liquidity solutions, ensuring timely exits and optimal appreciation.

- Access a global marketplace for artwork trading.

Data-Driven Investment Decisions with Institutional-Grade Tools

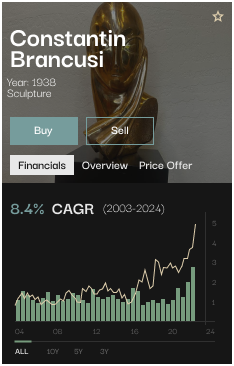

- Maximize AI-driven analytics with the Arty Traders Art Index & AVP (Artwork Valuation/Prediction) Tool, offering Real-time Valuation tracking.

- Gain actionable Market Intelligence through Market Insights, periodic Reports, and Real-Time investment Signals.

End-to-End Security & Compliance

- Partner with our network of leading art authentication experts to validate artwork and secure necessary appraisals and COAs.

- Comprehensive client reporting tools integrate seamlessly with existing portfolio management systems for transparency and accountability.

Art valuation

Art valuation

Art price prediction

Art price prediction

Portfolio builder

Portfolio builder

Database

Database

Integration and usage

Integration and usage

Artist and Artwork selection

Artist and Artwork selection

Liquidity

Liquidity

Fractional purchase

Fractional purchase

Case Studies

The firm specialized in traditional investment vehicles (stocks, bonds, real estate, and private equity) but faced increasing demand from ultra-high-net-worth clients (UHNWIs) seeking alternative assets to diversify and hedge against market volatility. The firm had no internal expertise in art investment and lacked data-driven tools to assess valuation, liquidity, and risk.

Solution:

Arty Traders integrated its proprietary Art Valuation and Price Prediction Model (AVP) directly into the firm’s portfolio management system, allowing wealth advisors to:

- Identify high-performing artworks from blue-chip artists and emerging talent.

- Provide 10-year price predictions to assess investment potential and ROI.

- Use ArTbitrage Smart Alerts to notify advisors when to acquire or sell artworks for maximum profitability.

Results:

- 12% average annual appreciation in selected artworks, outperforming traditional fixed-income investments.

- 35% of UHNW clients allocated more money to their portfolios, boosting AUM for the firm.

- Increased client retention & new asset inflows, as clients valued access to exclusive, insights-backed art investments.

Client Testimonial

“Arty Traders opened for us a new chapter in the art investment space. Their AI-driven insights, liquidity solutions, and innovative strategies helped us generate strong returns while minimizing risk. We now consider art as a core component of our alternative investment portfolio. Nice job!”

— Robert E., Managing Director, New York Family Office

Investment & Financial Returns

Arty Traders’ proprietary model combines off-market data, expert insights, and AI-driven valuation to identify undervalued artworks with high appreciation potential. Our valuation and price prediction tool continuously assesses factors such as the artist’s reputation, market demand, historical pricing trends and different aspects that reflecting on Artwork price change on live daily tracking chart shared with you.

Arty Traders provides consulting services for the Family Offices that want to organize a fractional ownership of any Artwork, including blue-chip and rising star artists’ artworks. Fractional purchase allows investors to purchase shares in high-value artworks rather than acquiring the entire piece. Investors can monetize their shares through secondary market sales, while the Family office that will own the artwork can receive rental income from exhibiting artworks in galleries and corporate spaces.

- Market Volatility: Art prices can fluctuate based on trends, economic conditions, and artist activity. That is why Arty Traders analyzes these factors regularly and provide you with Price alerts and Market insights.

- Liquidity Risk: While art remains less liquid than stocks or bonds, Arty Traders enhances liquidity through its proven network of art collectors, art dealers and art traders, who ensure that there will always be a buyer on Arty Traders platform.

- Authenticity & Provenance Risks: Ensuring legitimacy is critical, that is why Arty Traders mitigates this through expert authentication.

Art investments have historically shown resilience during economic downturns, acting as a hedge against inflation. Unlike crypto and stocks, which are highly volatile, art provides more stable, long-term appreciation. Art is also a tangible asset, making it more comparable to gold or real estate.

Fees include:

- Transaction Fees: Applied to buying, selling, or renting artwork.

- Subscription Fees: For accessing advanced analytics and AI-driven insights.

- Consulting fees: Arty Traders charge for personalized case-based consulting services.

By including art in client portfolios, family offices can:

- Offer high-net-worth clients a diversified investment option.

- Capitalize on long-term appreciation and passive income from artwork rentals.

- Increase AUM by attracting new investors seeking alternative asset classes.

Liquidity & Exit Strategies

- Fractional ownership enables partial exits.

- Price alerts notify investors of optimal selling windows.

- A secondary market allows investors to trade shares in artworks.

- Rental opportunities provide continuous revenue without requiring a full sale.

- A proven network of art collectors, art dealers and art traders ensure that there will always be a buyer on Arty Traders platform.

Our AI-powered Smart Exit Strategy analyzes:

- Market demand trends

- Auction results

- Artist activity

- Collector interest levels

- Comparable artwork sales

Investors receive real-time price alerts when data suggests a high-value exit opportunity

ArTBItrage is our proprietary price alert system, leveraging:

- Global price tracking to find price discrepancies across markets.

- AI-driven historical analysis to predict short-term appreciation.

- Off Market data and public information monitoring to identify undervalued pieces.

This enables investors to capitalize on market inefficiencies by buying low and selling high.

Technology & AI-Powered Tools

The AVP tool combines:

- Historical sales data

- Artist market trends

- Artwork composition & style analysis

- Macroeconomic indicators

- Gallery & auction activity

- Off-market data

- Expert assessment

It provides real-time price predictions, helping investors make data-driven decisions.

Yes. Arty Traders offers API integration for portfolio management platforms, enabling seamless tracking, valuation updates, and investment reporting.

Valuations are updated in real time based on:

- Recent transactions

- Market trends

- Off market transaction data and Auction results

- AI-based price predictions

AI plays a crucial role in analyzing vast datasets, identifying investment opportunities, and detecting market shifts with high accuracy (>85%). It evaluates historical price trends, artist reputation, collector demand, and macroeconomic factors in real-time to provide data-driven insights. However, since art also has a subjective element—driven by cultural trends, emotional appeal, and expert opinion—our team of seasoned art experts always provides the final validation for the results displayed, ensuring a balanced approach that combines AI precision with human expertise.

Authentication & Security

Arty Traders provide services of authentication, through its network of art experts to verify provenance.COA (Certificate of Authenticity) is one of the most requested certifications.

Our network features renowned art historians, gallery owners, and forensic analysts with credentials from leading Auction Houses and Art Institutions.

Arty Traders prevents fraudulent transactions and ensures provenance verification through a combination of AI-driven analysis, expert authentication. Our AI scans provenance records for inconsistencies, while a network of art specialists cross-validates ownership history and authenticity.

Higher ROI with diversified portfolio

Higher ROI with diversified portfolio Art Valuation & Price Prediction (AVP) model

Art Valuation & Price Prediction (AVP) model ArTbitrage and Smart Exit Alerts

ArTbitrage and Smart Exit Alerts Off-Market data and unique opportunities

Off-Market data and unique opportunities Capitalize on market shifts and Optimize liquidity

Capitalize on market shifts and Optimize liquidity Real-time Market

Real-time Market